This case was created to show that even if you think you have limited data, it is possible to find valuable insights and reduce the cost for a service. Data analysis is gaining momentum in creating value for real estate owners and service providers (SP). Now if Ai Outcome can create value from limited data sets, imagine what artificial intelligence could do when BMS and larger sets of data are used. McKinsey (June 2018) estimates up to 45% savings in project cost for infrastructure investors.

Canadian Building Unlimited (CBU)

CBU is a large real estate owner and manager. The company grew from a few offices and commercial building to one of the preeminent players in North America with buildings in Canada, USA, Europe and Asia. Over the years, their asset base grew from $250 M to $25 B through a series of acquisitions and organic growth.

CBU decided to put under a long-term contract their “CBU 1 Plaza”, a 1.5 million square feet plus office/retail complex recently acquired in downtown Toronto. After an RFP process CBU chose Engineering Services Technology (EST) because CBU valued EST’s claim that it could save over 5% on operating costs per year excluding energy and increase tenant satisfaction. CBU awarded EST the full operational responsibility for “CBU 1 Plaza” at a fixed cost 10-year Facility Management (FM) contract with detailed performance objectives, plus four 5-year options, for a potential 30 years contract.

EST’s challenge was to meet all financial and performance requirements and generate a gross margin of 15% in the first year with an expected average of 20% over the first 5 years. EST management knew there would be a ramp up in the first year for the CBU project.

After 12 months, EST“CBU 1 Plaza” project team met EST executives for their performance review. The meeting was rough as EST’s results were below target with a gross margin of 12%. EST suspected the local team did not understand the dynamics of the building well enough and would have difficulty ramping up gross margin to the 20% average over 5 years.

EST recognized that to push the envelope further they needed to go beyond normal operations and analyze data to find more insights on the dynamics of the CBU operations.

EST hires Ai Outcome (AiO) to uncover operations insights

Some EST executives had heard about a start-up company performing sophisticated data analytics in the field of infrastructures and more specifically in buildings. After an introductory meeting a mandate was awarded to AiO to find ways to improve operational margins using the available data.

After cleaning and validating the CMMS (Computerized Maintenance Management System) data retrieved, AiO was unfortunately faced with a limited set of usable data covering only one full year of operations. For example, no Building Management System (BMS) was available as the system automatically flushes 2-week-old data as new data are produced, and unfortunately CBU did not keep any history of the BMS data. No cost data were made available either.

AiO nevertheless proceeded with the analysis using their experience both in data science and infrastructure O&M. AiO investigated a number of avenues as they correlated some data, to finally get to some interesting insights that would help EST achieve their goals.

First: optimizing Opex

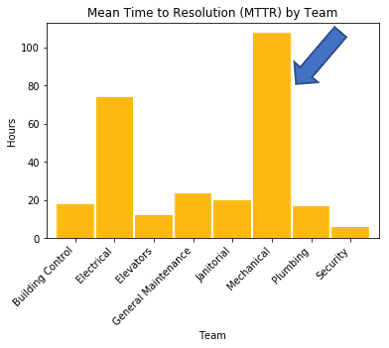

AiO wanted to find a way ETS could improve the mix of operational staff to be deployed in order to optimize Opex while ensuring timely completion of all work orders. They analysed the Mean Time To Resolution (MTTR) data for various technical team/services.

AiO recommended to local CBU managers talk with the technical teams on mechanical and electrical issues, using some of the graphical representations. They came up with some conclusions for EST executives:

Electrical: Investigate what accounted for the difficult months of January and August, e.g., an unusual number of incidents which required external support, delaying resolution time. Could providing additional training and tools to the local electrical team improve service and reduce subcontractor costs?

Plumbing: Response time is short, and performance is stable. Could the plumbing team be reduced by 1 person and relocated him to another building?

Mechanical: AiO used NLP(Natural Language Processing) techniques to read the notes left by the technicians on the work orders, AiO found that the absence / late delivery of some parts resulted in abnormally long delays for the mechanical team. Janitorial / General Maintenance: Investigate with subcontractor the potential re-balancing of hours between Janitorial and general maintenance in order to optimize MTTR and reduce overtime

Improving occupant comfort

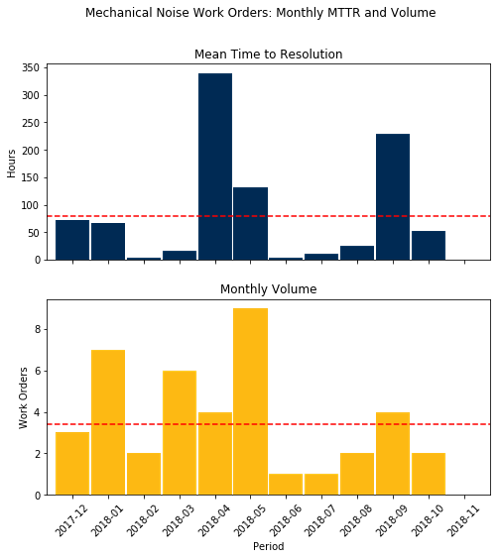

AiO found some abnormal MTTR on noise tenant calls. If MTTR is too high on noise occupant calls, this can create dissatisfaction with the tenants.

AiO graphs showed that 1 CBU Plaza experienced an abnormally high MTTR for Mechanical Noise issues in the Spring and Fall, corresponding to the annual start-ups of the main A/C and heating systems, respectively.

The high MTTR was not due to an abnormally-high volume of work orders since these were only average for the months of April and September.

The root cause of this problem, again after AiO reads the notes on the work orders, was due to late delivery / shortage of HVAC parts and consumables at these critical periods of the year. This also created quite a major loss of time with the mechanical team.

The recommendation was to review the relevant tasks in the CMMS and ensure all parts and material were ordered in advance of season changes and delivered on time to avoid shortages and time inefficiencies for the mechanical team.

Improving tenant satisfaction

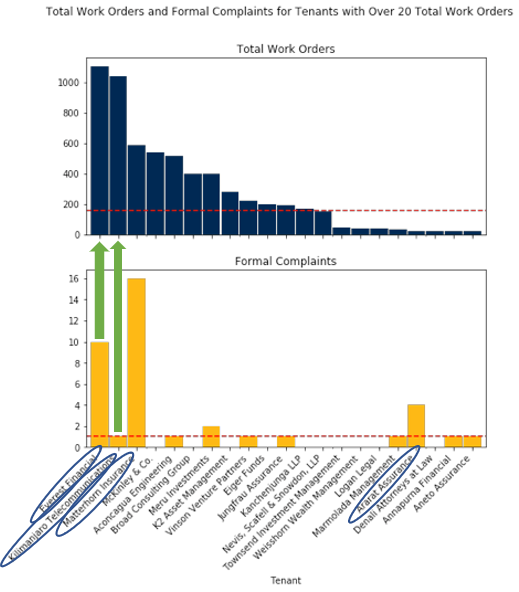

After analysing the noise complaints, AiO started looking at all available data tagged to tenants, AiO found an interesting correlation between service calls and formal complaints with some tenants.

AiO observed that Ararat Assurance and Matterhorn Insurance had the highest ratio of Formal Complaints to Work Orders, while Everest Financial and Kilimanjaro Telecommunications had the highest absolute volume of work orders.

Then they asked EST to look at the satisfaction survey and Net Promoter Score (NPS) results they had and found that the four tenants identified gave low satisfaction scores in general and especially on comfort and building Operation & Management (O&M) in general.

EST recommended to their local team to improve communications with the identified tenants. They organized building mechanical room visits for tenants and occupants, which improved tenant understanding and business relationship.

Finally, they suggested to educate tenants and occupants on how the building systems work.

Increase subcontractor performance

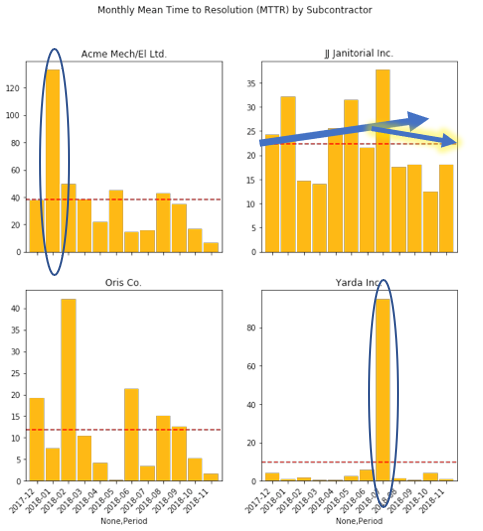

AiO verified if subcontractors were performing as expected. They analysed the MTTR of the four major subcontractors: Acme Mech./Elec., JJ Janitorial, Oris Elevators and Yarda Security.

AiO observed that Acme Mech/El and Yarda experienced performance anomalies in January and July, respectively. The monthly MTTR performance was stable otherwise.

EST shared those observations with their local CBU team who compared these results to tenant surveys for those months. These showed a higher level of dissatisfaction with them. The analysis with subcontractor’s managers proved that during those difficult months, there were some employees on extended leave and their replacements were definitely not up to the task.

AiO observed that the resolution time performance of JJ Janitorial was up and down until mid-year and inferior to the desired level for a janitorial subcontractor in such a prestige building.

Although the last third showed signs of improvement, EST suggested that the CBU team initiate discussions with JJ Janitorial to implement a continuous improvement program in order to increase their performance level as well as consistency.

Digging deeper into MTTR

AiO was surprised the number of MTTR work orders for mechanical was so high (refer to figure 1) and decided to explore this further.

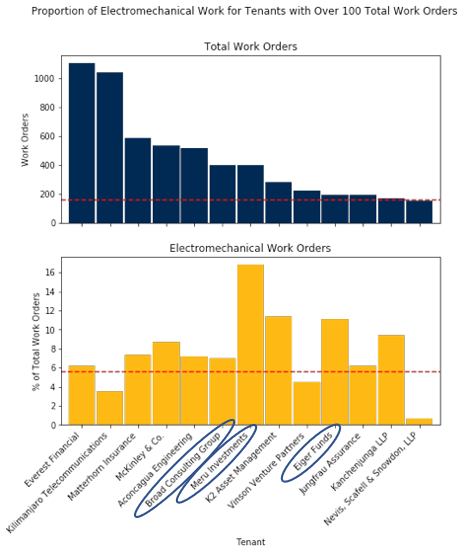

AiO wanted to identify tenants with abnormally high MTTR of electro-mechanical equipment; try to trace these measures to specific sectors / systems of the building and target them for further technical investigation.

Looking at the correlated results, it became clear that Meru Investments, K2 Asset Management and Eiger Funds have the highest ratio of electromechanical issues to total Work Orders.

EST compared these results to Mechanical drawings and identified that an HVAC system was common to the three tenant suites. EST recommended to the local team, after investigating the condition of the said system, to modify the CBU CAPEX investment plan to prioritize the upgrade or replacement of the offending HVAC system.

After the analysis, the game plan

EST were satisfied …and happily surprised with AiO’s findings and admitted they would not have come close to those conclusions without data analytics.

EST could now see clear benefits:

- Electrical: Savings with external sub-contractors.

- Plumbing: Potential to reduce by 1 plumber.

- Mechanical: Make the team more productive by providing them earlier with the appropriate material and parts in spring and fall.

- Janitorial / General Maintenance: Re-balance janitorial and general maintenance staff to optimize MTTR, improve their performance and reduce overtime.

- Improve communications with a few identified tenants. This will improve their mutual understanding of needs and issues.

- Talk to Acme mechanical/electrical subcontractor to avoid very high peak in any month.

- Performing a thorough assessment of the HVAC system servicing complaining tenants and review the CAPEX priorities for its upgrade or replacement.

EST realized that the data captured is never thoroughly analyzed and there is an opportunity to continue this work with AiO!

The results

After 6 months of implementing the solutions triggered by the AiO analysis, EST did reach a margin of 15% and felt they could improve further their performances and reach their objective of 20% (over 5 years) within 12 months. The tenants are showing improvements in their satisfaction survey. Tenant representative visits of the technical rooms found to be a success and did improve the communication in their requests when calling the Customer Support Centre and their Net Promoter Score (NPS) went up.

CBU also achieved their objectives and are now gearing up to collect and store their valuable data for further analysis and improvements in their other buildings: BMS, IoT, call centre, financial, security and other data will now be made available to AiO, EST’s new value-added business partner, confirming the now popular quote from Peter Sondergaard at Gartner Research:

“Information is the oil of the 21st century, and analytics is the combustion engine.”

What Artificial Intelligence from Ai Outcome can do for real estate owners and service providers

Developments in IoT, Big Data and AI are happening fast, and experts believe that fundamental changes are about to happen in infrastructure operation, creating significant opportunities for real estate owners and service providers: energy management, automation, customer service, etc. Those organizations who will step up and leverage their data and appropriate analytics tools early will become dominant players in the market.